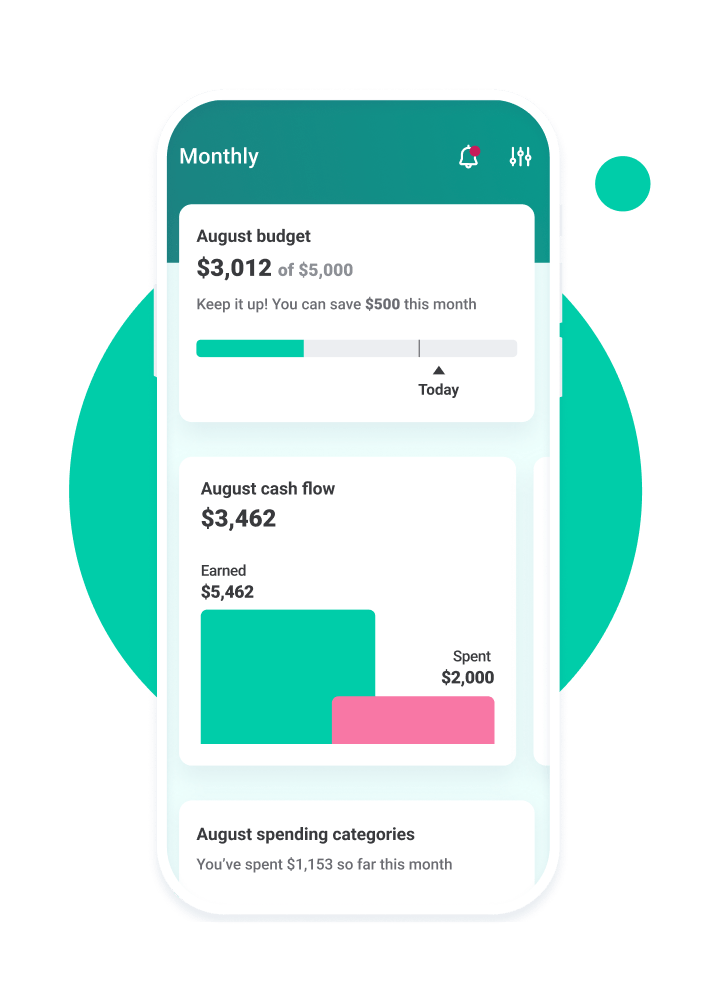

Although already a solid balance-keeper and financial assistant in previous versions, Quicken 2010 adds a few new features to visualize your monthly budget and assets.

You’ll stay aware of your spending, know when you’ve been overcharged, and can identify where to trim expenses and make improvements.With Quicken 2010, Intuit strives to make its flagship money management application easier to navigate and simpler to set up, thanks to spruced-up visuals and a refreshed start-up wizard.

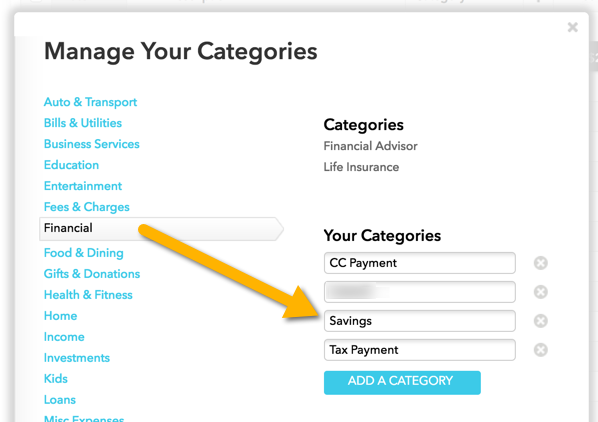

By auto-paying your bills with Prism, bank account or credit card, and then reviewing your accounts every week or month in Tiller, you can enjoy the best of both worlds: automation and engagement. Keep manually tracking your spending, including auto bill payments.Īt Tiller, we believe hands-on engagement is key to true financial confidence and control. Here are some tips for putting your scheduled bills on a calendar. You can also create an alert when a charge is over a certain amount, to help prevent fraud.Īlso, even though Mint Bill Pay is discontinued, Mint still supports bill reminders and due alerts that many will find helpful. Use billing alerts. It’s a good idea to pair automatic payments with alerts that notify when a bill is due or when your balance is low. These include credit cards (if you pay them in full) and cell phone plans that fluctuate month to month. Schedule variable payments directly Certain variable payments should be paid through the service provider itself. Some people prefer a bit of extra control: they pay everything electronically, but rather than paying automatically, they manually click “send payment” from their bank account. It’s also easier to dispute or suspend charges. This works especially well for fixed payments such as mortgages, student loans, and retirement transfers.īy keeping multiple payments in one place, it’s easier to track, control, and adjust payments. A Simple Automatic Bill Pay Strategyĭepend on your bank’s auto bill pay service first. For most people, it makes sense to schedule nearly all payments directly through your bank account’s bill pay service. But some bills deserve special review or don’t qualify for automatic payment. You don’t want monthly payments for various accounts scattered all over the internet. It can be confusing to choose the best automatic bill pay method. Which Auto Bill Pay Method is Right for You? The potential for accidental overcharges.Service fees for online autopayments (increasingly rare).Some people have trouble with continued payments even after they move or cancel service.Lack of control depending on how bills are paid.Overdraft fees when a bill auto pays from an account with a low balance.Never forget to pay a bill – even when you’re super busy or traveling.It’s important to note that while automatic bill payment is helpful, it does carry some risks.

#Quicken mint bill free#

Dedicated bill pay apps generally offer more features than banks, such as alerts, forecasting, and spending dashboards. Now that Mint Bill Pay is discontinued, many people are moving to Prism, a free app with automatic bill tracking, due date notifications, and easy bill pay.ĭirect payments to the provider. For example, when your cell phone company automatically charges your credit card for a month of service.

If you pay your bills through a credit card instead of a bank, you might qualify for points, cash back, or other rewards. (But you’ll also have one more credit card bill to pay.) Almost all big banks such offer this functionality, as do many credit unions. These include:īill pay through bank or credit card. Most banks now make it easy to set up recurring payments, pay bills and transfer money directly from your bank account. That’s probably because many other automatic bill pay options abound. On forums such as Reddit, Mint users are venting frustration that Mint Bill Pay is discontinued. However, in a comment to Lifehacker, a company rep said they simply “ did not see a high volume of users paying bills through Mint.” This feature allowed Mint users to view bills and schedule payments directly from the app. Intuit recently announced that Mint Bill Pay is discontinued and will cease functioning on June 30.

0 kommentar(er)

0 kommentar(er)